Christian Gollier, Frederick van der Ploeg, Jiakun Zheng, 2023, Journal of Environmental Economics and Management, Volume 122, Issue 102882.

»

Economic experts recommend using project-specific discount rates,

but they penalize risky public projects far less than financial markets penalize private investments.

RESEARCH PROGRAM

When assessing public programs that encompass costs and benefits over time, the initial step involves discounting monetary units to their present value. This process leads to the computation of the net present value (NPV), a pivotal metric used to select projects aimed at maximizing collective value. The choice of social discount rates plays a significant role in determining a project’s NPV. In many cases, the benefits of a project are tied to macroeconomic growth. Should the same discount rate apply to projects with different risk profiles, such as expanding Intensive Care Unit (ICU) capacity in response to a pandemic and economic downturns, and increasing railway line capacity during economic booms? The standard asset pricing approach recognizes the ICU project’s insurance benefit by discounting its expected net benefits at a lower rate than for the railway project, which intensifies macroeconomic volatility.

However, in practice, different countries often determine discount rates differently from theoretical suggestions. France stands out as the only country using risk-adjusted discount rates. Failure to adjust rates for projects with different risk profiles results in misallocation of public funds, with socially undesirable risk-increasing projects passing NPV tests and socially desirable risk-reducing projects failing. Gollier (2021)* warns that using a uniform discount rate may result in a permanent loss exceeding 20% of GDP share.

How much progress did our profession achieve in building a science-based consensus on the social rate of discount? We explore this issue by reporting the results of a survey on the opinions of a broad sample of professional economists. We go beyond either estimating the average cost of productive capital or calibrating the Ramsey rule, as in the literature, to examine broader questions related to the potential desirability of having different discount rates for projects with different risk profiles.

*Gollier, C. (2021). The welfare cost of ignoring the beta. TSE working paper.

PAPER’S CONTRIBUTIONS

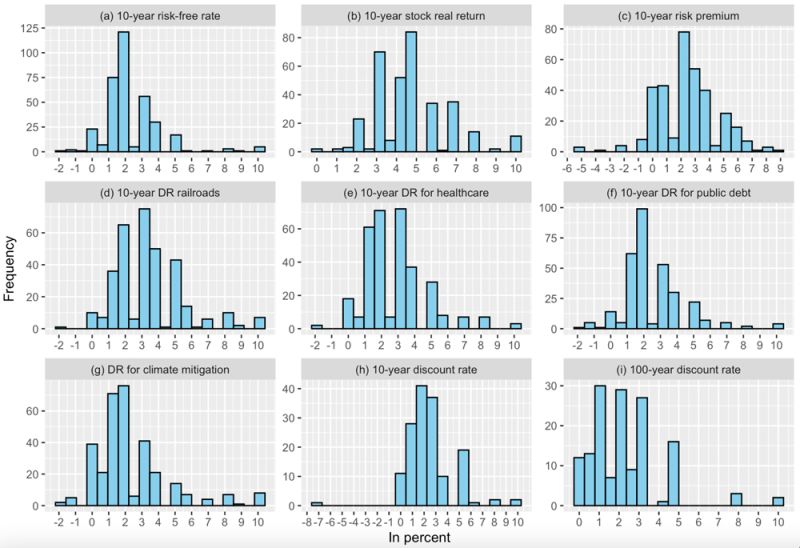

Our main finding is that three-quarters of the 948 surveyed professional economists recognize the need to adjust discount rates to the risk profile of the projects under scrutiny, following the principles outlined in the modern asset-pricing literature. However, another discovery from our survey is that when comparing projects with very different risk profiles, experts discriminate between discount rates much less than financial markets have over the last century or so. Among the six specific discount rates surveyed (see Figure 1), the lowest and highest mean discount rates are 2.28% (climate mitigation) and 3.38% (railways), respectively. This suggests that when risk-adjusting, respondents use a relatively small aggregate risk premium to adjust sectoral rates based on projects’ betas, defined as the elasticity of projects’ future benefits to changes in future aggregate consumption. In contrast, a 6.4% equity premium was observed in the U.S. between 1889 and 2010, leading to a «discounting premium puzzle». Furthermore, risk does not seem to be accounted for in the recommended rate for discounting marginal global warming damages, given that the mean climate discount rate (2.28%) is not statistically different from the mean risk-free discount rate (2.30%) in our sample.

Surveying discounting attitudes in our profession can be highly meaningful. The views of economists are often considered significant in the context of public investment decisions because they provide valuable insights into economic principles, theories, and empirical analysis. Economists study and analyze various factors that influence investment decisions, including discount rates. Their expertise in assessing the trade-offs between present and future costs and benefits can be instrumental in determining appropriate discount rates for long-term projects with intergenerational implications. Our survey provides strong support for public decision-makers to change their discounting guidelines. It shows that a vast majority of the surveyed professional economists believe that governments should stop using a single discount rate for public evaluations.

Figure 1. Histogram depicting risk-adjusting economists’ point estimates for different rates

FUTURE RESEARCH

Baumol (1968) pointed out over fifty years ago that the social rate of discount is a topic in our discipline that combines a significant degree of knowledge with a notable level of ignorance. Our study suggests that economists have gleaned insights from the theories developed over the years to address the uncertainties identified by Baumol (1968)** regarding the discounting system. However, our survey respondents seem hesitant to broadly differentiate discount rates based on risk, in contrast to the discernment exhibited by financial markets over the last century.

One possible interpretation of the «discounting premium puzzle» is that respondents believe decision-makers do not derive their risk attitudes from saving and investment decisions in financial markets, but rather let these be governed by their own ethical and pragmatic attitudes. Another key factor potentially explaining some inconsistencies with project-specific betas in asset-pricing theory is the presence of political economy considerations. Despite the procyclical returns associated with railways and the resulting higher project-specific discount rates, individuals may apply a lower discount rate for such projects due to political factors, given the influence of strong transport departments and lobbies. The next step in our research is to delve deeper into understanding the roots of the «discounting premium puzzle.» This exploration will aid in designing a more effective discounting system to maximize the common good.

**Baumol, W.J. (1968) «Entrepreneurship in Economic Theory», American Economic Review, 58, 64-71.

→ This article was issued in AMSE Newletter, Winter 2023.