Jeanne Amar, Christelle Lecourt, 2023, International Business Review, 32(6)

»

Our results reveal a U-shaped relationship between SWF internationalization and governance quality.

RESEARCH QUESTION

Sovereign wealth funds (SWFs) are state-owned investment funds financed by excess foreign currency reserves, trade surpluses or public pension assets. Rising oil prices, financial globalization and sustained large global imbalances have, since 2007, increased the size of SWFs until they are now among the world’s largest institutional portfolio investors, with resources estimated at more than USD 11.5 trillion in assets under management as of February 2023. These funds have become important actors in the global political economy in the last two decades. The literature on SWFs points to shifting financial power, as potential political actors and protectionist government responses reveal fundamental concerns over how SWFs are governed. Although SWFs have improved their transparency in recent years, as evidenced by the signing of the Santiago principles by many countries, most funds continue to release little financial, operational or governance information. This opacity generates mistrust and protectionism on the part of recipient countries regarding investments and raises questions about SWFs’ real motivations and the goals behind their investments.

In this paper, we provide a better understanding of what drives SWFs to promote their governance quality. Since governance includes transparency and accountability, a better understanding of the opaqueness (or lack thereof) of SWF governance rules should lead to a better understanding of their real motivations and of the challenges involved in improving their governance and the incentives for funds to do so. In particular, we attempt to determine whether the governance quality of these stateowned institutions is driven by the search for internal or external legitimacy. Depending on their initial objectives, SWFs have to attempt to manage the multilevel agency issues they face while considering their legitimacy at home and abroad.

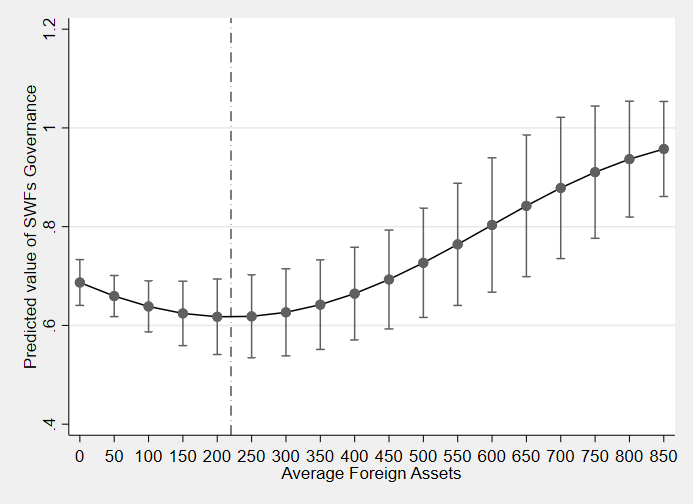

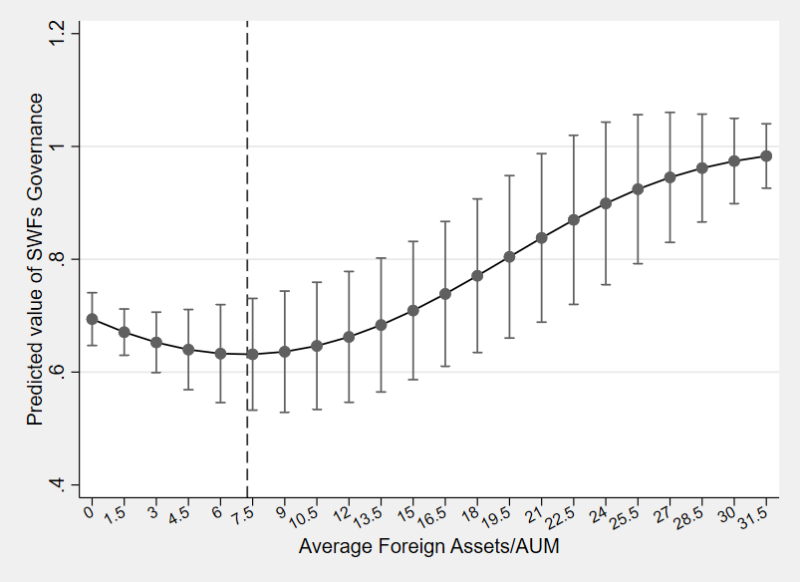

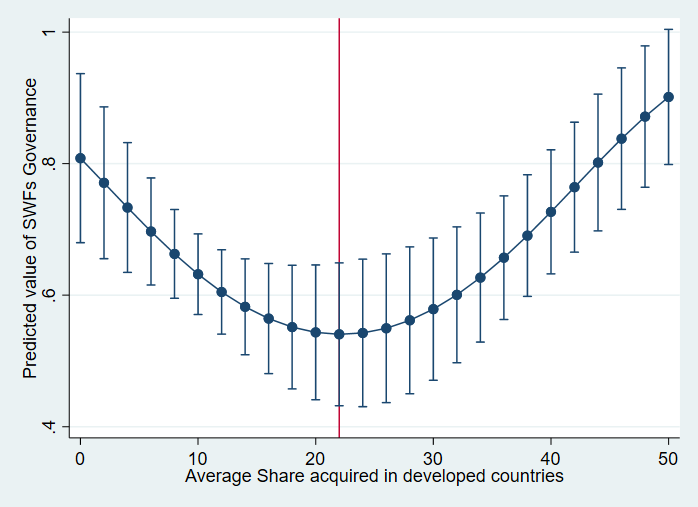

Figure 1: Average marginal effects for baseline models

PAPER’S FINDINGS

Our study indicates that home country characteristics (policy regime and national governance) impact SWF governance quality. More precisely, we find that governance is better at SWFs originating from democratic countries with high-quality national governance. This result is in line with the theory of institutional legitimacy, according to which the legitimacy of state institutions is deeply conditioned by country- and culture-specific conditions and is embedded in the local political context and practice of state sovereignty. Therefore, SWFs with an enhanced bias towards home assets need to have domestic legitimacy to limit agency issues and can achieve this through better governance and/or greater transparency.

Our results also show that SWFs tend to improve their governance quality when they need to acquire external legitimacy vis-a-vis the target company and its government. In particular, our results reveal a U-shaped relationship between SWF internationalization and governance quality (see figure 1). This means that SWFs have an incentive to improve their governance when they are sufficiently internationalized and when the amount of foreign assets invested abroad is sufficiently large. In other words, the incremental effect of internationalization on SWF governance remains negative until the level of internationalization reaches the critical point at which the marginal cost of internationalization equals the marginal benefits. This threshold is even higher for funds targeting developed countries.

POLICY IMPLICATIONS

These results suggest that SWFs have an incentive to improve their governance when they are sufficiently internationalized, when the amount of foreign assets invested abroad is sufficiently large or when the quantity of shares acquired in developed countries is significant. These findings demonstrate how SWFs may proactively build legitimacy in host countries when they need to adapt their foreign entry strategies.

Our results have important implications for understanding the determinants of SWF governance and may be of interest to host countries. A better understanding of the opaqueness or transparency surrounding SWF governance rules should make it possible to discern what is truly at stake in the operation of these funds.

→ This article was issued in AMSE Newletter, Summer 2024.