Michael B. Devereux, Karine Gente, Changhua Yu, 2023, The Economic Journal, Volume 133, Issue 653.

»

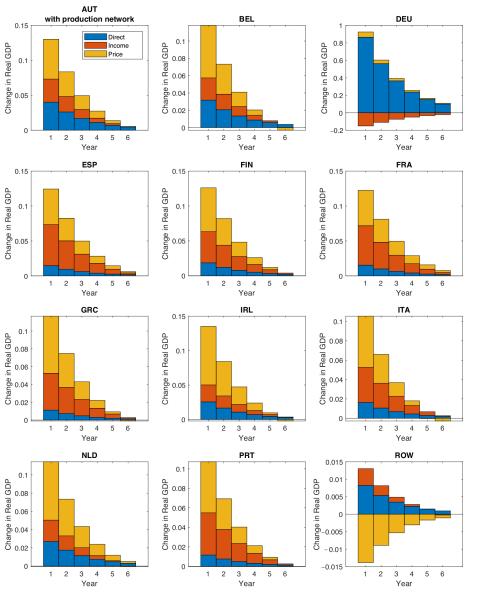

We show how the domestic and international production network operates through a direct,

an income and a price channels to propagate the public spending shock.

The recent economic shocks have shown a real and fast contagion around the world. This article deals with the propagation of fiscal shocks from one country to another, measuring international fiscal spillovers in the Eurozone. Empirically, international fiscal spillovers are quite high but not in accordance with the results of theoretical literature. We develop an approach in order to reconcile model with empirics based on a network structure. We show that when wage adjustment is costly, the network of intermediate good products really matters for fiscal spillovers.

We construct a theoretical model based on an extension of Bigio and La’O1 (2020) in order to analyze the impact of fiscal spending shocks on real value-added GDP that operates within and across countries. We introduce a dynamic setting with international capital mobility and costly wage adjustment. We show how the domestic and international production network operates through a direct, an income and a price channels to propagate the public spending shock. The decomposition is then applied to the countries of the Eurozone using empirical input-output measures. We focus particularly on the Eurozone international production linkages among Eurozone countries are high, with a common currency. Thus, the nominal exchange rate regime plays no role in the diffusion of fiscal shocks across borders within the currency union. Fiscal spillovers generated by the model are in line with empirical estimates from the literature when wages are sticky.

The Direct Effect pertains to the way in which a government spending shock in a source country directly affects demand for the output of the domestic or foreign sector, both directly and indirectly through production networks. This Direct effect appears to be always positive, and does not depend on the stance of monetary policy, even in the presence of sticky nominal wages.

Figure 1. Output responses from a one-percent of GDP increase in German Government spending

when nominal wages are fully sticky in the national currency.

The Income Effect captures the way in which the spending shock affects value added GDP through private sector demand both within the source country and across other countries, working through a-temporal and inter-temporal channels, and also affecting demand for intermediate goods through the production network. The Income Effect may be positive for some countries and negative for other countries, and depends on the stance of monetary policy.

The Price Effect captures a type of networkadjusted real exchange rate, and measures the impact of the fiscal spending shock on an index of the prices of government and private sector absorption prices relative to wage costs. Again this operates not just directly through measured price indices, but through the effect of prices on demand through the production network.

Figure 1 presents this decomposition for our calibration on 12 countries: 11 countries of the Eurozone (EZ hence after) and the “rest of the world”. The model is calibrated using the measures of input-output connections from the World Input-Output Database for this set of countries.

In the paper, we present three sets of results, which differ based on the degree of capital mobility, the degree of wage rigidity, and the stance of monetary policy. An overview of these results is given by Figure 1 which depicts the decomposition into our three effects of a spending shock arising in Germany in the basic version of the static model. Spillovers of a German spending shock to other Eurozone countries are quite large. The Direct Effect of the shock is a relatively small component of the total average spillover. The largest part of the spillover comes from the Price Effect, which is positive for all Eurozone countries, even Germany, but negative for the rest of the world. The Income Effect is also positive for all Eurozone countries except Germany. We show in the paper that these three effects compensate when wages are sticky to finally give very low spillovers.

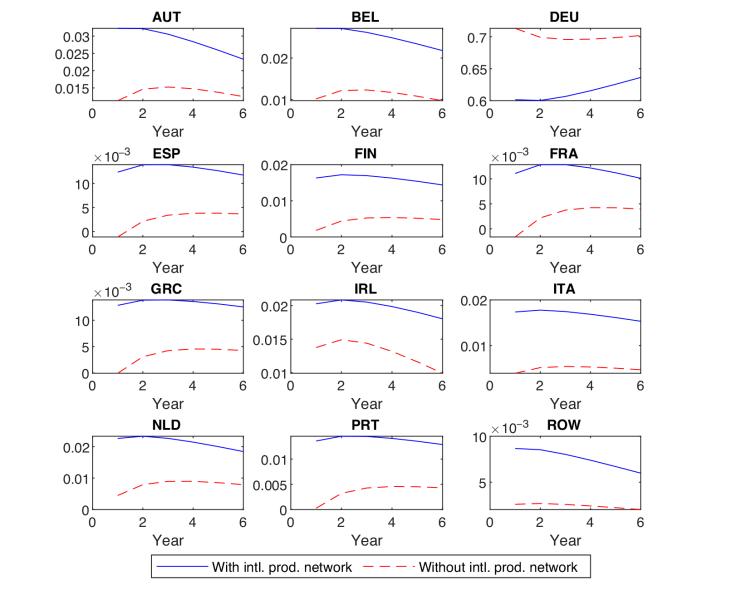

We extend the analysis to a fully dynamic setting with capital mobility, partially stickyy wages. Figure 3 shows that the production network matters for cumulative responses when monetary policy in the EZ set by a Taylor rule which targets country weighted overall EZ CPI inflation.

We finally show in the paper the cumulative responses and the decomposition into the three effects assuming that the nominal interest rate is constrained by the zero bound for a finite number of periods. With no response of the EZ interest rate, we find very large cross country fiscal spillovers, much larger even in the first static economy specification.

Figure 2. Cumulative responses of real GDP to a one-percent of GDP increase in German Government spending

when monetary authorities stabilise CPI inflation.

1 «Distortions in Production Networks», Saki Bigio , Jennifer La’O, 2020, The Quarterly Journal of Economics, Vol 135(4), 2187–2253.

→ This article was issued in AMSE Newletter, Summer 2023.

© Photo by Funtap on Adobe Stock