Anja M. Hahn, Konstantin A. Kholodilin, Sofie R. Waltl, Marco Fongoni, 2023, Management Science, forthcoming.

»

This paper is the first to analyse the short-run effects of the rent freeze on rent prices

as well as on the quantity of residential units in Berlin and surrounding areas.

RESEARCH QUESTION

Following the rapid increase in residential rents in the 2010s, Germany began to expand rent control policies. In 2020, Germany’s capital Berlin introduced a radical rent control policy: the rent freeze (in German Mietendeckel). Only 13 months after its enactment, the policy was declared unconstitutional and subsequently abolished.

Upon enactment in February 2020, rents within the administrative borders of Berlin were ex-post frozen at the June 2018 level for five years. The policy allowed for predefined mark-ups based on location and other amenities, but it effectively enforced a maximum rent ranging between 3.92 and 9.80 €/m2 per month. With few exceptions, such as premises that had been modernised and were therefore new on the market, all residential units were covered.

Berlin’s rent freeze can be considered a first-generation rent control policy as opposed to today’s standard second-generation policies that combine market incentives with tenant-protective measures. As such, the Berlin rent freeze meant a step back in time.

The rent freeze was successful in lowering the overall level of newly advertised rents within Berlin. Its announcement drew broad media attention worldwide. Politicians in other countries saluted the policy initiative, which also had an appealing ring to the ears of renters. However, it was not clear what the potentially unintended consequences of such a policy for Berlin’s rental housing market and neighbouring areas would be.

In this paper, we explored the immediate price and quantity effects of the rent freeze within and around the Berlin administrative area. We focused on the supply side of the rental property market, by assessing changes in landlords’ decisions to advertise properties for rent.

PAPER’S FINDINGS

This paper is the first to analyse the short-run effects of the rent freeze on rent prices as well as on the quantity of residential units in Berlin and surrounding areas.

We analyse landlords’ vacancy posting decisions through the lens of a simple theoretical framework on the rental market that captures some key features of the rent freeze. These include the option of investing in modernisation and the practice of “double-pricing rents” to hedge the expected shortfall in rents under the freeze---that is, advertised rents would feature a clause that if the rent freeze was abolished, tenants would subsequently have to pay a substantially higher rent to compensate the landlord for rent foregone earlier. Then, we test the predictions using microdata on rental advertisements and employ causal inference techniques to measure the size of the immediate price effects within and around Berlin.

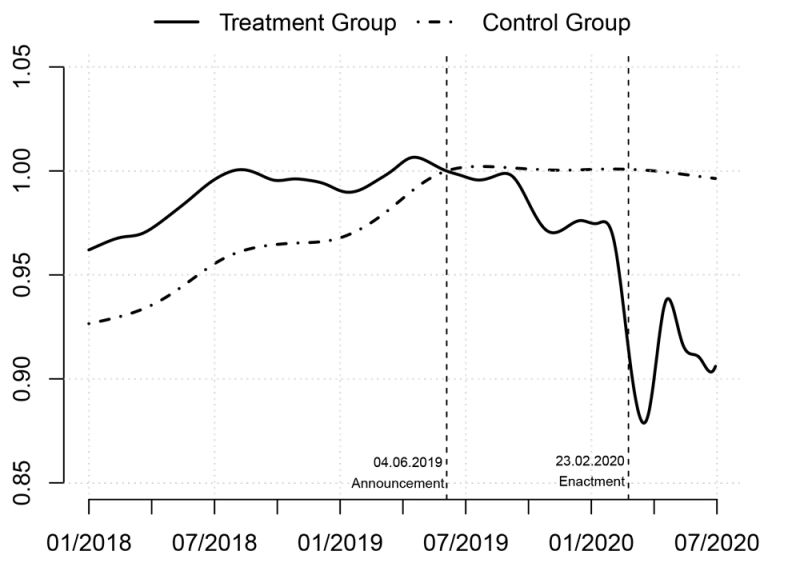

We document a remarkable immediate aggregate drop of 7-11% in advertised rents as compared to those of unregulated units (see Figure 1). We also document a substitution effect from the rental to the sales sector, with sales and rent indices following opposite trends after the policy enactment.

Figure 1. Price trends in the treatment and control group

Source. Author’s visualization based on data provided by VALUE Marktdaten. Notes. The indices show the general trend of prices in the treatment versus control group between 2018 and the end of the second quarter 2020.

Indices control for observable hedonic features and are normalized to the announcement date (June 4, 2019). The time-continuous indices follow the methodology developed in Waltl (2016) based on adaptive smoothing techniques.

Further, we document a spill-over effect towards Berlin’s neighbouring city Potsdam and smaller municipalities, with asking rents surging at an accelerated pace after the enactment. This resulted in windfalls for landlords renting out properties just outside the administrative border of Berlin.

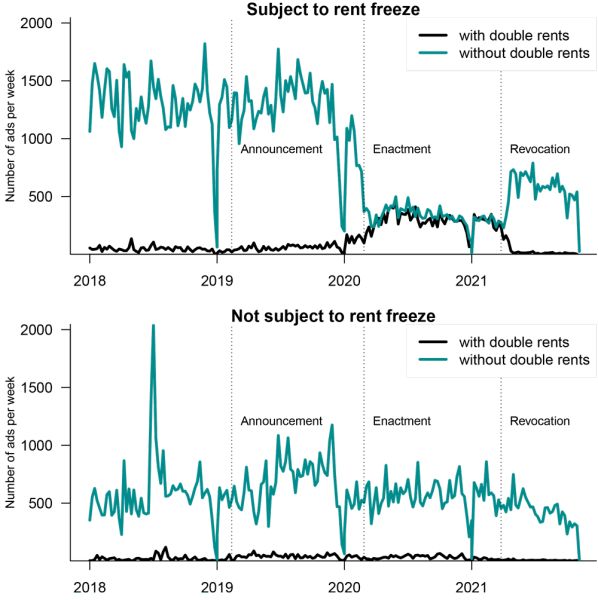

This finding is supported by a substantial and likely lasting decline in the number of rental units advertised in Berlin (see Figure 2). For instance, the incentives for modernisation under the rent freeze led to a loss of affordable older residential units We find empirical evidence in support of three main channels: increased conversions of rental to owneroccupied units; reduction in newly built dwellings; decrease in properties advertised.

Figure 2. Number of advertisements

Source. Author’s visualization based on data provided by Immobilienscout24.

Notes. The black line shows the number of advertisements stating double rents, whereas the gray one displays the number of advertisements without double rents.

Two vertical lines indicate the enactment and revocation of the rent freeze, respectively. Spikes depict the typical monthly, quarterly, and year-end dynamics.

POLICY IMPLICATIONS

Rigorous price restrictions limiting owners’ returns appear short-sighted if they are not accompanied by strategies to sustain the supply of rental units. The rent freeze was short-lived, but it provided a glimpse of the unintended consequences of introducing overly strict but not sufficiently well-designed policies in a rental market facing distress.

Because of reduced supply, seeking housing within the rental segment became increasingly challenging both for established tenants and for new entrants. Young workers (the largest group moving into German cities) faced the combined challenge of low income and reduced availability of housing.

Our study shows that first-generation rent freezes do more harm than good. This points towards the desirability of alternative policies combining more modern rent control designs or other regulatory attempts to improve housing affordability without negatively impacting the supply of residential units. These include vacancy taxes and incentives for revitalising older residential neighbourhoods, as well as indirect policies such as higher minimum wages, which have been shown to have positive effects on the rental market.

→ This article was issued in AMSE Newletter, Winter 2023.

© Photo by Vidar Nordli-Mathisen / Unsplash